Pennystock Supernovas

Timothy Sykes has a great framework to focus on stocks that usually run pre-market. The step to focus on is step 3:

Step #1: The Pre-Pump or Promotion

Step #2: Ramp

Step #3: Supernova

- This step represents the peak of the stock's price increase during the pump. It's often the point where the stock achieves its highest valuation due to the cumulative effect of the promotion. At this stage, there's typically high volatility, with the price possibly fluctuating widely even within a trading day. It's a critical moment for traders to decide whether to sell or hold, as the price might not go higher without substantial new positive developments.

The supernova is usually the result of a short seller squeeze. So check for a build up of shorts on a stock and start looking from 4 or 5 EST.

Step #4 onwards is shorting, which is risky, but I would follow Rob Booker's framework for this step.

The rest I wouldn't play but are:

Step #5: Dip Buy

Step #6 -

The Dead Pump Bounce: This step describes a bounce back

in stock price due to residual interest or buying from investors who

missed the initial pump or believe in a recovery. However, this bounce

often lacks the initial momentum and can be misleading.

Step #7 - The Long Slow Kiss Goodnight: Here, the stock's price gradually declines over time as the last bits of interest fade. This phase can be extended, with the stock price slowly finding its true value or sinking to lower levels without significant buying interest.

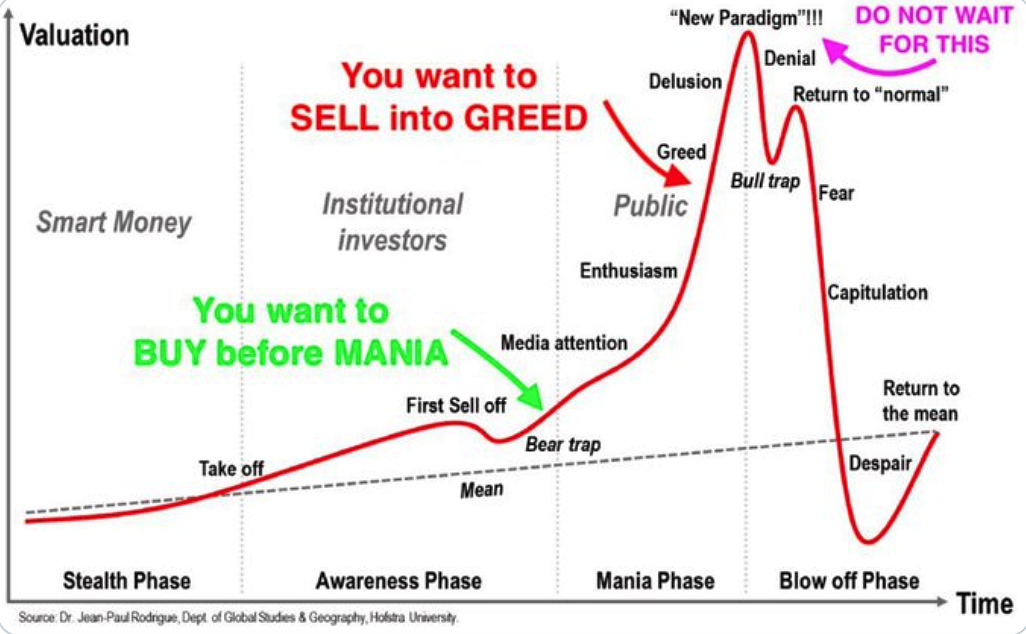

It seems to mirror the Greed and Fear chart:

Read more on the framework by Tim:

https://www.timothysykes.com/blog/7-step-pennystocking-framework/